We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

The Federal Open Committee (FOMC) is comprised of the 7 members of the Federal Reserve Board of Governors (nominated by the President and confirmed by the Senate), the president of the Federal Reserve Bank of New York, and 4 other rotating presidents from the remaining 11 Fed Banks. The FOMC represents the voting members of the Federal Reserve System.

The FOMC will almost certainly not be changing its current policy when its meeting is summed up this afternoon, but changes in interest rate and balance sheet outlook could certainly be market moving. Watch for changes in the FOMC’s statement release at 2 pm EST today (6/16), followed by a press conference led by Fed Chair Jerome Powell at 2:30 pm.

The recent outsized inflationary data remains in line with the Fed's 'transitory' viewpoint, and I don't expect Fed officials to change their stance purely on short-term statistics. However, one thing that is slightly concerning to me regarding Fed officials' fresh outlook is the rate of inflation’s acceleration. May just illustrated the largest year-over-year core inflation jump in almost 3 decades.

The Fed uses the PCE index to judge inflation as opposed to the more well-known CPI inflation scale, but both generally move together. The Fed's current outlook for PCE inflation in 2021 is 2.4%, with a range of 2.1% to 2.6%. For the first 4 months of the year, this figure is well within that range at 2.25, but this doesn't include May's figures (being released June 25th), which are poised to be much higher.

That being said, all these pricing pressures remain transient…for now. Employment data, the other half of the Fed's dual mandate, is likely going to drive decisions on shorter-term balance sheet tapering (the first step in raising rates). However, unemployment data hasn't been as strong as many anticipated with the unemployment rate sitting at 5.8% for May (a long way from last February’s 3.5%), despite job openings sitting at a record high. This differentiation is being caused by unemployment stimulus, which is disincentivizing society from going back to work and causing wage inflation (which is much more sticky than over pricing pressures). Half of US states are ending the additional $300 a week in unemployment, pushing 4.1 million unemployed American’s back to work. It won't be long before the jobs markets hit a level of supply/demand parity.

I don't expect to see any material changes in outlook in this June FOMC meeting. Another untouched dot-plot chart combined with an unchanged Fed stance of "not even thinking about, thinking about raising rates" would likely catalyze the next push higher that this now Fed-trusting market has been waiting for.

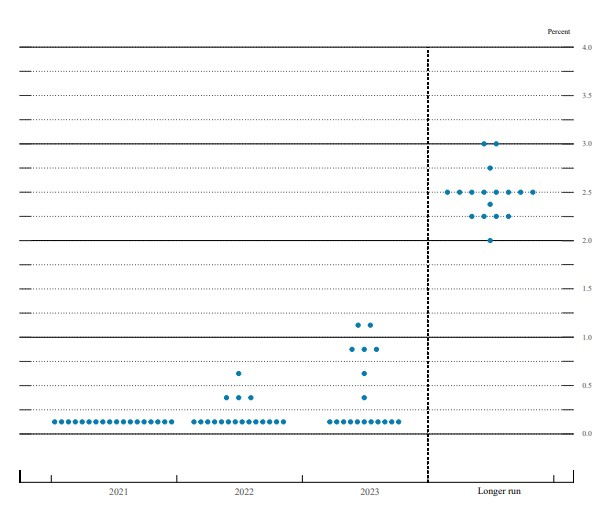

As of the FOMC's March meeting, the dot-plot chart consensus is that the Fed will maintain its current nearly 0% Fed Funds rate through 2023, with a longer-run target of 2.5%.

How To Read The Fed’s Dot-Plot ChartImage Source: federalreserve.gov

Above is the FOMC's dot-plot chart from its 2-day March meeting, which I got from the federalreserve.gov site. Despite the FOMC only having 12 members, voting and non-voting members (the 7 non-voting Fed presidents) contributes their Fed Funds rate outlook to the dot-plot chart because of the voting rotation among Fed presidents. The dots represent each Federal Reserve member (19 members, but it appears that only 18 voted in March).

The FOMC dot-plot chart is one of the most scrutinized statistical charts on Earth, as it represents the map to where the world's most powerful central bank is headed in the coming years. Unfortunately, there is no way of identifying which dot belongs to what Fed official, but you better believe that analysts attempt to put a name to the outliers.

Final Thoughts

If the Fed's transitory inflation viewpoint remains, you want to be holding profitable growth companies, such as Amazon (AMZN - Free Report) , or Microsoft (MSFT - Free Report) . On the other hand, if the Fed provides a shortened timeline on changes of either of its levers (Fed Funds rate or balance sheet purchases), expect a broader market sell-off, propelled by growth stocks. Either way I see an opportunity: ride the next wave higher or buy on a dip.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

Image: Bigstock

What To Expect From The FOMC This Afternoon

The Federal Open Committee (FOMC) is comprised of the 7 members of the Federal Reserve Board of Governors (nominated by the President and confirmed by the Senate), the president of the Federal Reserve Bank of New York, and 4 other rotating presidents from the remaining 11 Fed Banks. The FOMC represents the voting members of the Federal Reserve System.

The FOMC will almost certainly not be changing its current policy when its meeting is summed up this afternoon, but changes in interest rate and balance sheet outlook could certainly be market moving. Watch for changes in the FOMC’s statement release at 2 pm EST today (6/16), followed by a press conference led by Fed Chair Jerome Powell at 2:30 pm.

The recent outsized inflationary data remains in line with the Fed's 'transitory' viewpoint, and I don't expect Fed officials to change their stance purely on short-term statistics. However, one thing that is slightly concerning to me regarding Fed officials' fresh outlook is the rate of inflation’s acceleration. May just illustrated the largest year-over-year core inflation jump in almost 3 decades.

The Fed uses the PCE index to judge inflation as opposed to the more well-known CPI inflation scale, but both generally move together. The Fed's current outlook for PCE inflation in 2021 is 2.4%, with a range of 2.1% to 2.6%. For the first 4 months of the year, this figure is well within that range at 2.25, but this doesn't include May's figures (being released June 25th), which are poised to be much higher.

That being said, all these pricing pressures remain transient…for now. Employment data, the other half of the Fed's dual mandate, is likely going to drive decisions on shorter-term balance sheet tapering (the first step in raising rates). However, unemployment data hasn't been as strong as many anticipated with the unemployment rate sitting at 5.8% for May (a long way from last February’s 3.5%), despite job openings sitting at a record high. This differentiation is being caused by unemployment stimulus, which is disincentivizing society from going back to work and causing wage inflation (which is much more sticky than over pricing pressures). Half of US states are ending the additional $300 a week in unemployment, pushing 4.1 million unemployed American’s back to work. It won't be long before the jobs markets hit a level of supply/demand parity.

I don't expect to see any material changes in outlook in this June FOMC meeting. Another untouched dot-plot chart combined with an unchanged Fed stance of "not even thinking about, thinking about raising rates" would likely catalyze the next push higher that this now Fed-trusting market has been waiting for.

As of the FOMC's March meeting, the dot-plot chart consensus is that the Fed will maintain its current nearly 0% Fed Funds rate through 2023, with a longer-run target of 2.5%.

How To Read The Fed’s Dot-Plot Chart Image Source: federalreserve.gov

Image Source: federalreserve.gov

Above is the FOMC's dot-plot chart from its 2-day March meeting, which I got from the federalreserve.gov site. Despite the FOMC only having 12 members, voting and non-voting members (the 7 non-voting Fed presidents) contributes their Fed Funds rate outlook to the dot-plot chart because of the voting rotation among Fed presidents. The dots represent each Federal Reserve member (19 members, but it appears that only 18 voted in March).

The FOMC dot-plot chart is one of the most scrutinized statistical charts on Earth, as it represents the map to where the world's most powerful central bank is headed in the coming years. Unfortunately, there is no way of identifying which dot belongs to what Fed official, but you better believe that analysts attempt to put a name to the outliers.

Final Thoughts

If the Fed's transitory inflation viewpoint remains, you want to be holding profitable growth companies, such as Amazon (AMZN - Free Report) , or Microsoft (MSFT - Free Report) . On the other hand, if the Fed provides a shortened timeline on changes of either of its levers (Fed Funds rate or balance sheet purchases), expect a broader market sell-off, propelled by growth stocks. Either way I see an opportunity: ride the next wave higher or buy on a dip.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>